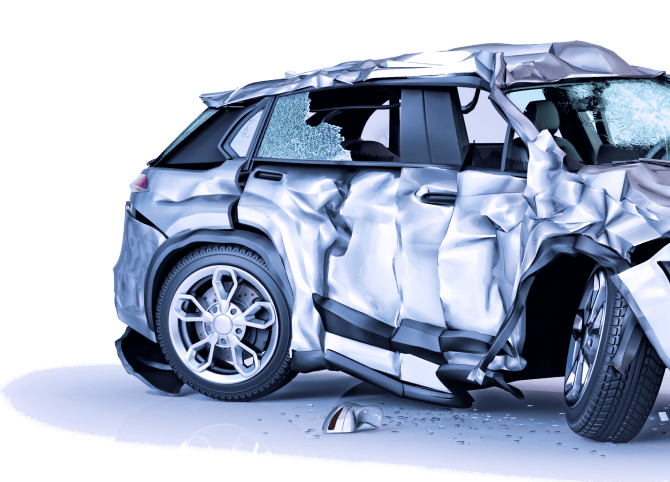

Did you know that your car’s value can go down even after it’s been repaired following an accident? This is the diminished value of your vehicle, and it can be a real pain in the neck.

If you’ve been in an accident, you’re probably already dealing with much stress. You must deal with the insurance companies, the repairs, and the hassle of getting your car back on the road. The last thing you need to worry about is diminished value.

Luckily, DVGOAT is here to help you! Our expert diminished value appraisers have years of experience helping vehicle owners in California get successful compensation worth the damages.

Our money-back guarantee ensures that your recovery will at least match the cost of your report. If your recovery is less than what you paid for the report, we’ll refund 100% of the appraisal fee.

We’ll work with you at every step to ensure a successful diminished value appraisal.

Client Reviews

“After getting T-boned in an intersection by someone who ran a red light, I was furious that my new Jeep had one accident on the report. DVGOAT helped recover the difference in market value. I appreciate you guys!!!!”

Emilie Terry

CLIENT

“When my Range Rover got in an accident, and it wasn’t my fault, I was researching the diminished value and found DVGOAT. The process was simple and totally worth it. They walked me through the whole process and helped me get a check from the at-fault insurance company to recover the value of my vehicle.”

David Beck

CLIENT

“Within a week of contacting DVGOAT, I had a settlement with the insurance company. Gino at DVGoat did an outstanding job helping me navigate the DV claim process, and he put everything together for me to submit. Awesome company!”

Liam Trevino

CLIENT

Does California Allow Diminished Value Claims?

Yes, California does allow diminished value claims. Diminished value is the decrease in the value of a vehicle after it has been involved in an accident, even if the car has been repaired to its pre-accident condition (repair-related diminished value).

Even if all repairs have been performed, buyers and dealers prefer to purchase a car that hasn’t been in an accident. Filing for a diminished value claim allows you to be compensated for the loss in value.

California law requires that damages for diminished value can only be recovered from the party who damaged your car and is not typically recovered from Collision Coverage. It is also limited to the vehicle’s fair market value before the accident minus the cost of repairs. If you believe you deserve more money for the actual value of your car, contact the diminished value experts at DVGOAT.

What is the Statute of Limitations on Diminished Value Claims in California?

The statute of limitations is a legal deadline that you must meet to file a lawsuit. If you fail to file your claim within the statute of limitations, you will be barred from recovering any damages for your loss.

Diminished value claims California law states that you must file a claim three years from the accident date to be eligible for compensation.

How do I Claim Diminished value on my Car in California?

Filing a diminished value claim can feel daunting and overwhelming if you don’t have experience. Below are some tips on how to File a Diminished Value Claim in California.

Gather evidence and documentation: Document the details of the accident, the damage to your vehicle, and the repairs made. Take photographs of the damage before and after repairs, obtain copies of repair estimates and invoices, and keep any relevant paperwork related to the accident.

Review your insurance policy: Check your insurance policy to see if it covers diminished value claims. Some policies may include this coverage, but it’s not always standard.

Obtain a diminished value appraisal: To support your claim, you’ll need an official appraisal from a licensed appraiser. This appraisal should consider factors such as the age of the vehicle, its pre-accident condition, mileage, and the extent of the damage and repairs.

Contact the at-fault driver’s insurance company: Reach out to the at-fault driver’s insurance company and inform them of your intent to make a claim. Make sure you provide them with the following information:

Your name, address, and contact information

The date of the accident

The names and contact information of the other drivers involved in the accident

The VIN of your car

The cost of the repairs

It’s important to remember that claiming diminished value in California can be complex, and insurance companies may try to minimize their liability. Consider seeking advice from an experienced appraiser to ensure you understand your rights and have the best chance of obtaining fair compensation for your claim.

How is a Diminished Value Claim Calculated in California?

Calculating a car accident diminished value claim in California can be a complex process that requires a thorough evaluation of various factors. These factors typically include the age of the vehicle, its pre-accident condition, mileage, the extent of damage, and the quality of repairs. A professional appraisal from a licensed and experienced appraiser is crucial to assessing the diminished value.

Why Choose DVGOAT?

DVGOAT is a team of experienced diminished value appraisers who have helped thousands of vehicle owners in California get successful compensation. We are confident that we can help you too.

Here are just a few reasons why you should choose DVGOAT:

We have over 25 years of experience handling diminished value claims in California. We know the ins and outs of the process and can help you get the compensation you deserve.

We have a track record of customer satisfaction. We are committed to providing our clients excellent service and helping them get the best possible outcome.

We offer a risk-free experience with a money-back guarantee. We will refund your appraisal fee if you are unsatisfied with our services.

We will ensure you recover more than the cost of the appraisal report fee. We will work hard to get you the maximum amount of compensation possible.

If you have been in a car accident and have diminished value on your vehicle, contact DVGOAT today. We can help you get the compensation you deserve.

Need help with your California Diminished Value Claim?

If you’ve been in a car accident in California and believe your vehicle’s value has decreased, you must act fast! You have three years from the accident date to get compensation for the diminished value.

At DVGOAT, we have the necessary expertise to handle your auto accident claim. We know the ins and outs of the process and can help you get the compensation you deserve.

We will:

Assess the damage to your vehicle and calculate the diminished value you can claim.

Prepare and submit a report to the at-fault driver’s insurance company.

Negotiate on your behalf to get you the maximum amount of compensation possible.

Remember, we offer a money-back guarantee if you’re unsatisfied with our services. Get your free estimate today, and let’s discuss your specific needs!