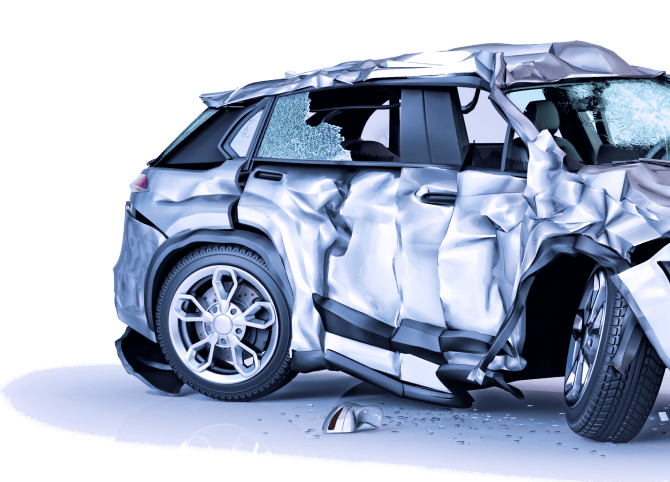

The sinking feeling after a car accident isn’t just about the damage but realizing that your vehicle’s value might never be the same. No matter how expertly repaired, the damage can affect what your car is worth in the eyes of buyers.

But what if we told you that you could get compensation worth more than the repair expenses through diminished value claims? That’s where DVGOAT comes in. With 25+ years of experience, we specialize in appraising diminished value in Connecticut to safeguard your investment’s worth. We have helped many vehicle owners get fairly compensated by their insurance companies after a car accident.

Our money-back guarantee ensures that your recovery will at least match the cost of your report. That’s right—if the compensation you recover is less than what you paid for our report, we’ll refund every penny of your appraisal fee. With DVGOAT by your side, you’re not just getting an estimate; you’re getting assurance that your vehicle’s diminished value is recognized and compensated more than the mere cost of repairs.

Is CT a Diminished Value State?

Connecticut is a diminished value state, meaning that you may be able to file a claim if you are the victim of an accident. Diminished value is the difference between the fair market value of your vehicle before the accident and its fair market value after the accident.

One thing to remember is that insurance companies are not required to pay diminished value claims. You must present evidence and arguments that support your position and sound convincing enough to be granted rightful compensation. Also, the amount of decreased value you can recover is limited to the actual cash value of the vehicle.

Types of Diminished Value Claims

When assessing the diminished value of your vehicle after an accident, it’s essential to recognize under which category it falls.

Inherent Diminished Value

This refers to the loss in value simply because the vehicle has been in an accident, even if the repairs have been correctly done.

Repair-related Diminished Value

This is the loss in value due to imperfect repairs. For example, non-original parts might have been used, or the repairs might have failed to restore the vehicle to its previous condition.

Immediate Diminished Value

This is the decrease in a vehicle’s value immediately after an accident and before any repairs.

How Long Do You Have to File a Diminished Value Claim in CT?

To file for a diminished value claim in Connecticut, you must file within two years of the accident. Connecticut does not have uninsured motorist coverage, and you cannot be the at-fault party to file for a claim.

How to File a Diminished Value Claim in Connecticut

Filing a diminished value claim can feel confusing if it’s your first time. Here are some tips to help you navigate the process effectively.

Gather your evidence: Gather all necessary documentation, such as the police report, photos of the damage, and estimates for the repairs.

File a demand letter with the at-fault driver’s insurance company: The demand letter should state the amount you are claiming and why you believe you are entitled to it. Attach the evidence you’ve collected to support your claim.

Seek a Professional Appraiser: Connect with a qualified appraiser, like DVGOAT, to assess the damage to your vehicle and determine the amount of diminished value.

Negotiate with the insurance company: proceed to negotiate with the insurance company for the compensation you seek. Notice that insurers will want to pay you as little as possible. Therefore, to maximize your payout, we advise letting your appraiser advocate on your behalf.

Settlement Agreement: If you reach a settlement agreement with the insurance company, get it in writing. Ensure that all terms are outlined and double-check before signing. You should get a deadline for when you will receive your payout.

Why Choose DVGOAT?

DVGOAT is a team of experienced appraisers who have helped thousands of vehicle owners in Connecticut get successful compensation. We are confident that we can help you.

Here are just a few reasons why you should choose DVGOAT:

We have over 25 years of experience handling Connecticut diminished value claims. We know the ins and outs of the process and can help you get the compensation you deserve.

We have a track record of customer satisfaction. We are committed to providing our clients with excellent service and helping them get the best possible outcome.

We offer a risk-free experience with a money-back guarantee. We will refund your appraisal fee if you are unsatisfied with our services.

We will ensure you recover more than the cost of the appraisal report fee. We will work hard to get you the maximum amount of compensation possible.

Our Satisfied Clients

“After getting T-boned in an intersection by someone who ran a red light, I was furious that my new Jeep had 1 accident on the report. DVGOAT helped recover the difference in market value. Appreciate you guys!!!!”

Emilie Terry

CLIENT

“When my Range Rover got in an accident, and it wasn’t my fault, I was researching diminished value and found DVGOAT. The process was simple and totally worth it. They walked me through the whole process and helped me get a check from the at-fault insurance company to recover my vehicle’s value.”

David Beck

CLIENT

“Within a week of contacting DVGOAT, I had a settlement with the insurance company. Gino at DVGOAT did an outstanding job helping me navigate the DV claim process, and he put everything together for me to submit. Awesome company!”

Liam Trevino

CLIENT

Need a Diminished Value Appraisal in Connecticut?

Ensure you get the compensation you rightfully deserve for your damaged vehicle! By selecting DVGOAT, you can access our in-depth local market knowledge and expertise with Connecticut diminished value laws. Get your free estimate today to discuss your specific needs!